An equitable social network, built to last.

WonderLive fixes the flaws of current platforms: creator exploitation, algorithmic toxicity, lack of structured social impact.

This page provides an overview. Detailed figures and financial documents are available in the data room, upon request.

85% to creators on tips (15% standard commission)

Web2.5: Simple UX, Web3 values

Safe-by-design (minors, moderation, brand safety)

VRR & WonderCare (redistribution + impact)

🎁 0% commission on tips for the 300 founding creators

Current social networks are broken.

Observed Problems

- ✗ Economic exploitation of creators (high commissions, monetization thresholds)

- ✗ Encouragement of buzz, conflict and toxic content

- ✗ Lack of algorithmic transparency

- ✗ Insufficient protection of minors

- ✗ Advertising models misaligned with user interests

WonderLive Vision

- ✓ Web2.5 social network that rewards quality over quantity

- ✓ Fairer redistribution: 85% to creators on tips (15% standard commission)

- ✓ Visibility algorithm based on WQS (public reputation score)

- ✓ Child protection by design (parental controls, moderation, strict rules)

- ✓ Progressive integration of VRR and ethical Ads systems

We don't claim to solve everything, but we're tackling the most destructive aspects of the current model.

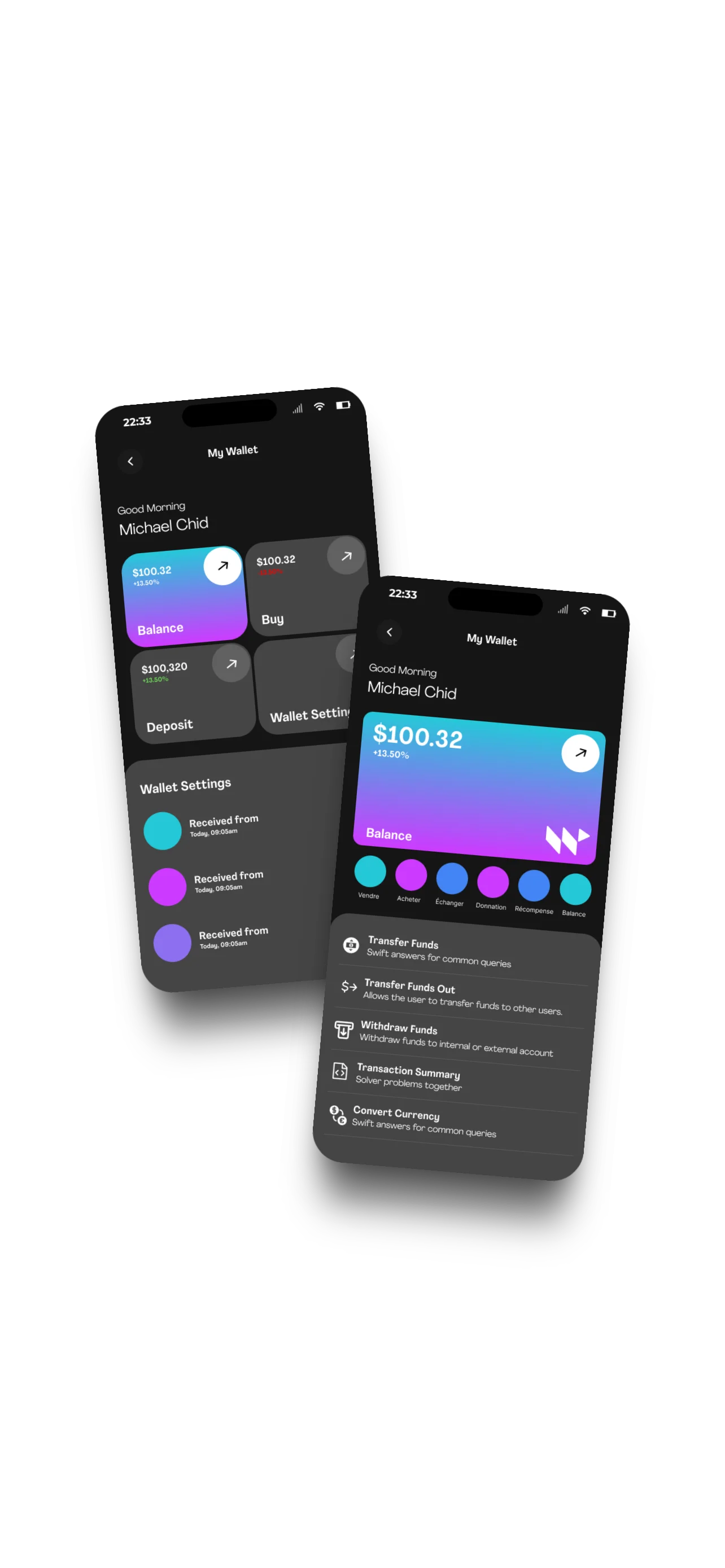

The MVP and the next steps of the project.

MVP1 (closed beta)

- 1 Instant tips (monetization from the 1st fan, 15% standard commission → 85% to creator)

- 2 XP & badges for the community (in development)

- 3 WQS (Wonder Quality Score) transparent (in development)

- 4 Parental controls & first moderation safeguards (in development)

Current status (pre-launch)

- • Closed beta with ~50 active users (private test phase)

- • ~300 founding creators being onboarded

- • Target public launch: Q1–Q2 2026 (depending on beta results & ongoing fundraising)

Product Roadmap (indicative)

Phase V1: MVP (fiat only, Tips only)

- → MVP1 launch with social base, posts, 85/15 tips, first version of WQS and safe-by-design

- → Onboarding of 300 Founding Creators (0% commission on tips)

Phase V2: Paid Lives (beta)

- → Free lives + first paid lives (tickets + live tips)

- → Event promotion (scheduling, countdown, discovery)

Phase V3: Creator Subscriptions

- → 1–2 paid subscription tiers per creator

- → Subscriber-only content (posts, lives, replays, community access)

Phase V4/V5: Ethical Ads & first verticals

- → Pilot launch of Ethical Ads / VRR Ads (brand-safe formats)

- → Start of simple verticals (events, digital products)

Complete product & TGE preparation

- → Scale lives, subscriptions and verticals

- → TGE/IBCO considered only if PMF confirmed and compatible window

Ethical Ads at scale & breakeven

- → VRR Ads scaling up

- → Goal: operationally sustainable model (breakeven)

This roadmap is indicative and may be adjusted based on traction, regulation and beta phase results.

More advanced features (complete VRR, Ads, token utility) are planned progressively, according to our product roadmap. Full details are in the product documentation and roadmap.

Between under-monetized creators and communities seeking alternatives.

Primary Targets

- 1 Mid-tier creators (5k–100k followers) under-monetized on current platforms

- 2 Communities tired of toxic feeds and intrusive advertising

- 3 NGOs/associations, CSR brands and institutions looking for more ethical frameworks

Positioning

- → European, ethical alternative, focused on redistribution

- → Web2.5: Mass-market UX + values of transparency, governance and impact

Alternative européenne

Face aux géants américains

We prioritize depth first (creators + engaged communities) before chasing massive volume.

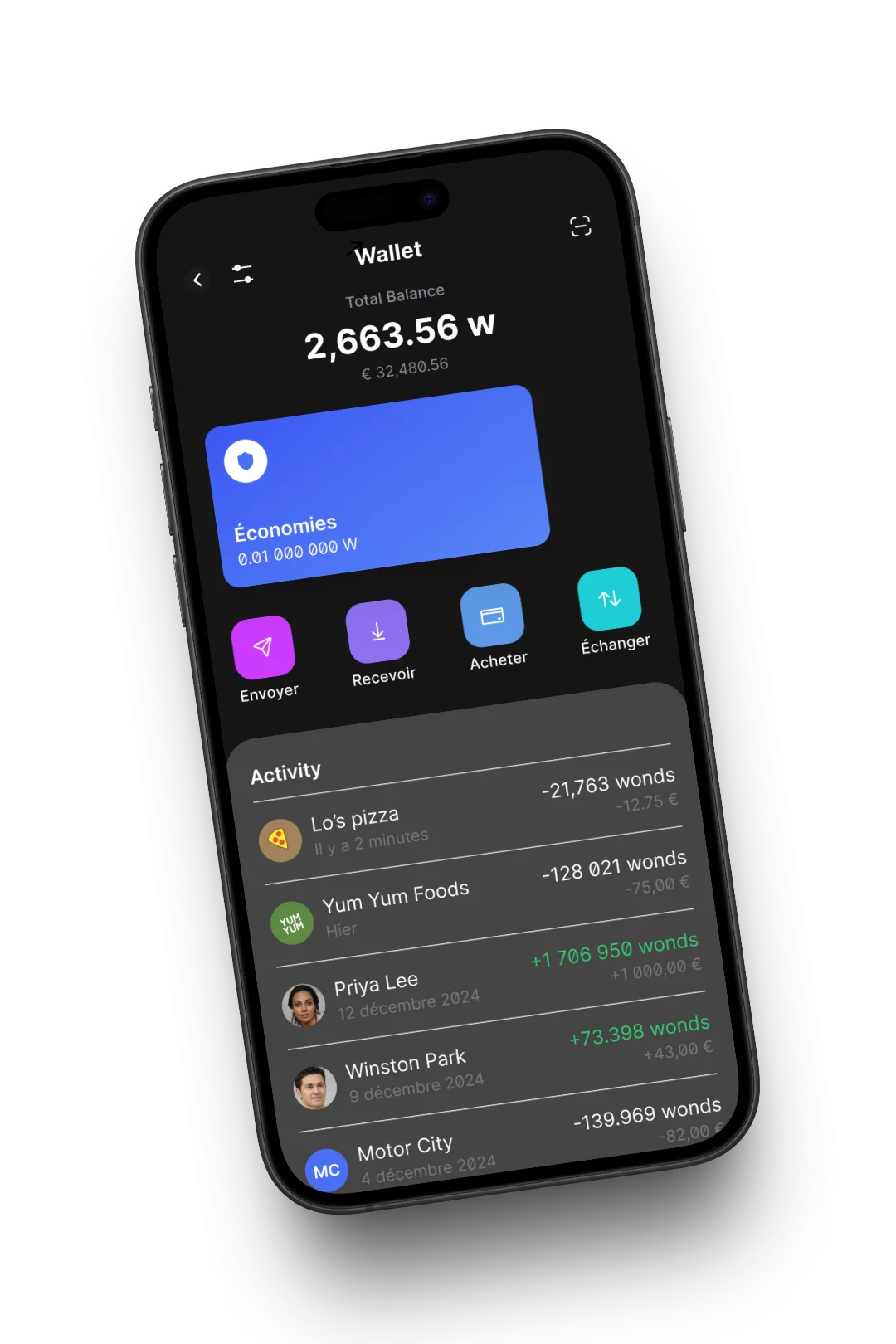

A multi-stream model, designed for sustainability.

💰 Main Revenue Streams (overview, no return promises)

Tips

15% standard commission → 85% to creator

Creator Subscriptions

(coming soon)

Marketplace

(services / digital products)

Ethical Ads / VRR Ads

(value sharing between users, creators, WonderLive)

💜 WonderCare & VRR

Part of WonderLive's margin funds the WonderCare Fund (social impact)

VRR (Value Redistribution Rules) defines how value is distributed among different stakeholders (creators, community, WonderLive, impact)

🪙 €WOND & VRR (in brief)

€WOND is designed as a non-speculative utility token, focused on product usage (governance, access, engagement rewards), not as an investment or return instrument.

VRR (Value Redistribution Rules) will ultimately define how value generated on WonderLive is distributed among: creators, certain community members, WonderCare (impact), and the platform.

Detailed aspects (€WOND, VRR, DAO) are covered in separate documents (whitepaper, specific terms, audits) available in the data room under NDA, and will be designed to comply with applicable regulatory frameworks (MiCA, FINMA, etc.).

All streams are designed to remain readable and auditable. Nothing on this page constitutes an offer of securities or tokens, nor a promise of returns.

Why now?

Creator and community fatigue

Under-monetized creators, burnout, dependence on a few central platforms. Audiences are seeking healthier alternatives.

Growing regulatory pressure

DSA, MiCA, child protection: current models will have to evolve, often under constraint. Better to be native than to adapt.

Maturity of Web2.5 building blocks

Payments, infrastructure, "mass-market" UX allow addressing the mainstream without crypto friction.

Few credible European alternatives

Opportunity for an EU player that integrates from the start: transparency, redistribution, impact.

We want to build a credible alternative before the wave of regulation makes changes even heavier and slower for incumbent players.

Type of partners we're looking for.

Target Profiles

- ✓ Early-stage funds interested in creator economy, Web2.5, social impact

- ✓ Business angels with product / growth / regulation / media experience

- ✓ Partners who can bring more than capital (network, expertise, credibility)

What we expect

Alignment on:

- → Long-term horizon

- → Equity / redistribution

- → Responsible approach to tokenization (no short-term speculation)

We prioritize partners aligned with the vision, not just the "potential multiple".

What this page is not.

-

!

This page does not constitute an offer of financial securities, nor a public solicitation.

-

!

The information presented (projections, scenarios, objectives) is indicative, not guaranteed and subject to change.

-

!

Elements related to the WOND token, VRR and VRR Ads are covered in separate documents (whitepaper, specific terms) and will comply with applicable regulatory frameworks (MiCA, FINMA, etc.).

Any potential investment would be made under a separate contractual framework, after provision of complete documents (deck, data room, term sheet if applicable).

Request investor access

Benefits of investing in Wonderlive:

We'll get back to you within a few business days. Data room access may be offered subject to mutual alignment and NDA signature.

Frequently Asked Questions (Investors)

Yes, via our private data room, under NDA. This page only provides an overview.

Details (amount sought, target valuation, use of funds) are shared directly with interested investors.

We take a progressive approach (Web2.5 → utility token), focusing on real usage and regulatory compliance, without return promises.

We're building WonderLive to last. Several scenarios are possible over a 5–7 year horizon: (1) Preferred scenario: sustainable organic growth, profitability, then opening (IPO or regulation-compatible public mechanism). (2) Strategic scenario: acquisition by an aligned player (creator economy platform, media/tech group). (3) Intermediate liquidity: new investor entries (Series A/B) with partial secondary possibilities. Exit is a consequence of sustainable success, not a goal in itself. Detailed scenarios are available in the data room.

Via the form below. After preliminary exchange and agreement in principle, we share data room access under NDA.

This FAQ does not replace a direct discussion or detailed information documents.